User login

Child of The New Gastroenterologist

‘So You Have an Idea…’: A Practical Guide to Tech and Device Development for the Early Career GI

You are in the middle of a busy clinic day and think, “there has to be a better way to do this.” Suddenly, a better way to do something becomes obvious. Maybe it’s a tool that simplifies documentation, a device that improves patient comfort, or an app that bridges a clinical gap. Many physicians, especially early career gastroenterologists, have ideas like this, but few know what to do next.

This article is for the curious innovator at the beginning of their clinical career. It offers practical, real-world guidance on developing a clinical product: whether that be hardware, software, or a hybrid. It outlines what questions to ask, who to consult, and how to protect your work, using personal insights and business principles learned through lived experience.

1. Understand Intellectual Property (IP): Know Its Value and Ownership

What is IP?

Intellectual property refers to your original creations: inventions, designs, software, and more. This is what you want to protect legally through patents, trademarks, or copyrights.

Who owns your idea?

This is the first and most important question to ask. If you are employed (especially by a hospital or academic center), your contract may already give your employer rights to any inventions you create, even those developed in your personal time.

What to ask:

- Does my employment contract include an “assignment of inventions” clause?

- Does the institution claim rights to anything developed with institutional resources?

- Are there moonlighting or external activity policies that affect this?

If you are developing an idea on your personal time, with your own resources, and outside your scope of clinical duties, it might still be considered “theirs” under some contracts. Early legal consultation is critical. A specialized IP attorney can help you understand what you own and how to protect it. This should be done early, ideally before you start building anything.

2. Lawyers Aren’t Optional: They’re Essential Early Partners

You do not need a full legal team, but you do need a lawyer early. An early consultation with an IP attorney can clarify your rights, guide your filing process (e.g. provisional patents), and help you avoid costly missteps.

Do this before sharing your idea publicly, including in academic presentations, pitch competitions, or even on social media. Public disclosure can start a clock ticking for application to protect your IP.

3. Build a Founding Team with Intent

Think of your startup team like a long-term relationship: you’re committing to build something together through uncertainty, tension, and change.

Strong early-stage teams often include:

- The Visionary – understands the clinical need and vision

- The Builder – engineer, developer, or designer

- The Doer – project manager or operations lead

Before forming a company, clearly define:

- Ownership (equity percentages)

- Roles and responsibilities

- Time commitments

- What happens if someone exits

Have these discussions early and document your agreements. Avoid informal “handshake” deals that can lead to serious disputes later.

4. You Don’t Need to Know Everything on Day One

You do not need to know how to write code, build a prototype, or get FDA clearance on day one. Successful innovators are humble learners. Use a Minimum Viable Product (MVP), a simple, functional version of your idea, to test assumptions and gather feedback. Iterate based on what you learn. Do not chase perfection; pursue progress. Consider using online accelerators like Y Combinator’s startup school or AGA’s Center for GI Innovation and Technology.

5. Incubators: Use them Strategically

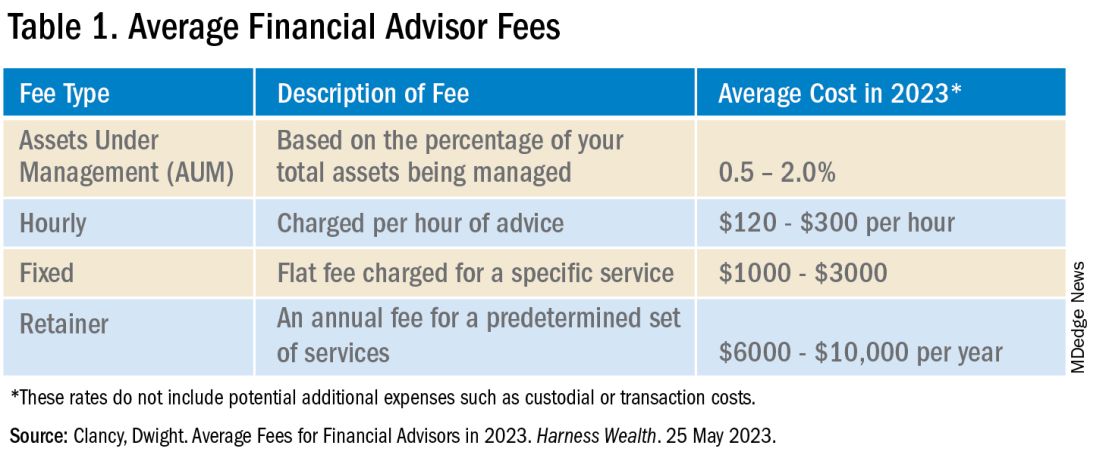

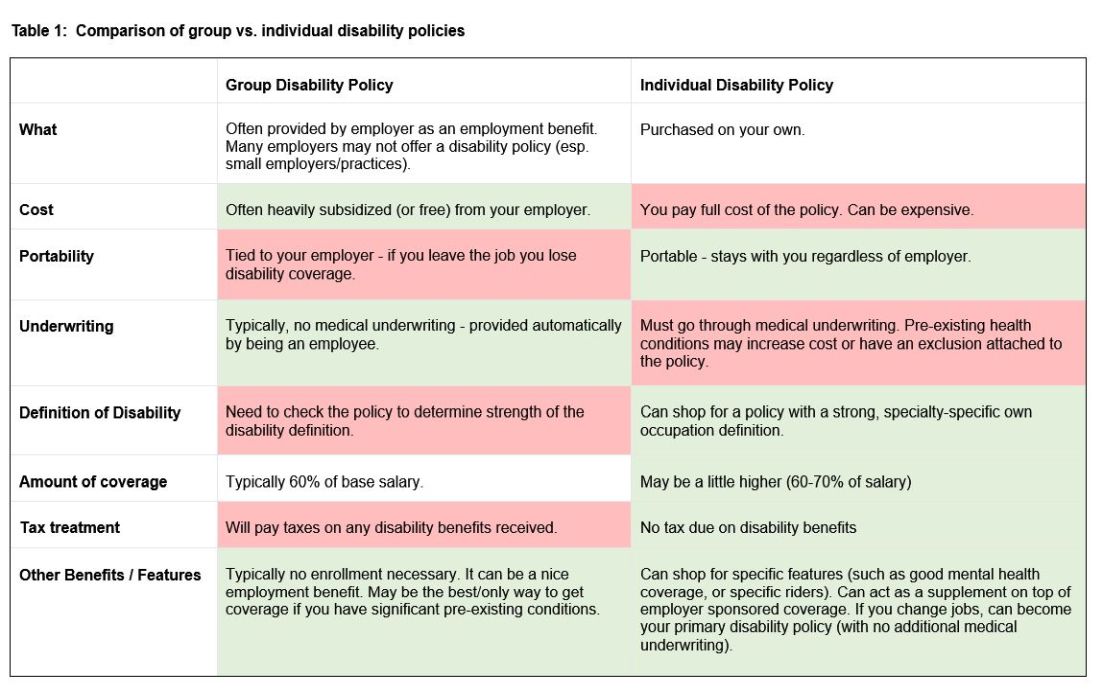

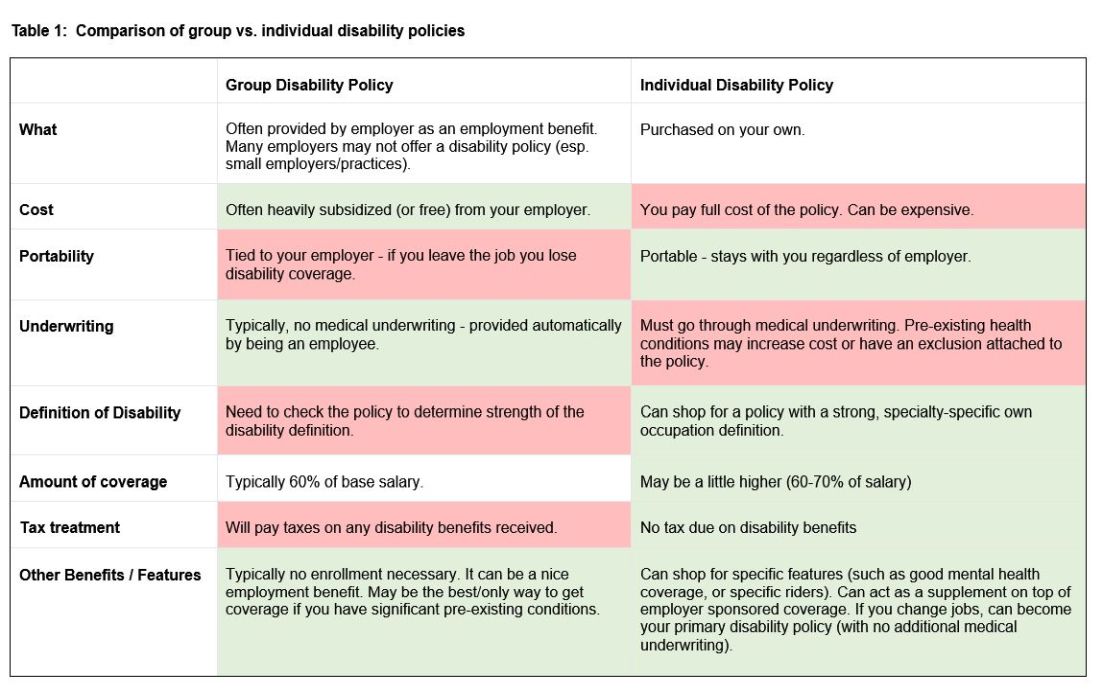

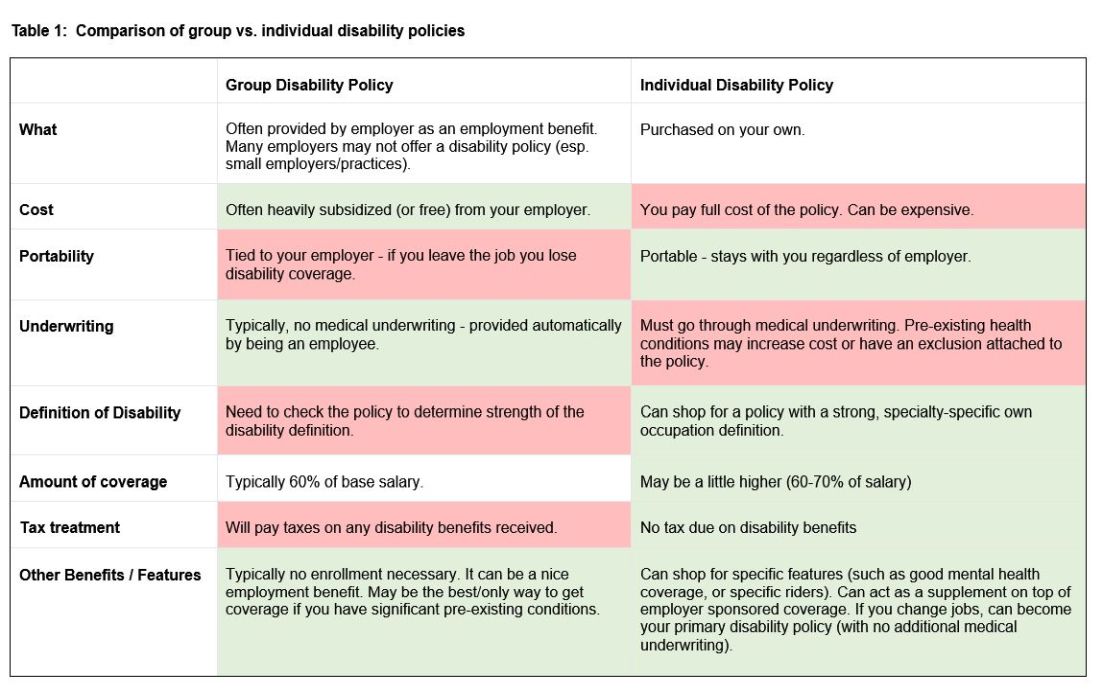

Incubators can offer mentorship, seed funding, legal support, and technical resources, but they vary widely in value (see Table 1). Many may want equity, and not all offer when you truly need.

Ask Yourself:

- Do I need technical help, business mentorship, or just accountability?

- What does this incubator offer in terms of IP protection, exposure, and connections?

- Do I understand the equity trade-off?

- What services and funding do they provide?

- Do they take equity? How much and when?

- What’s their track record with similar ventures?

- Are their incentives aligned with your vision?

6. Academic Institutions: Partners or Pitfalls?

Universities can provide credibility, resources, and early funding through their tech transfer office (TTO).

Key Questions to Ask:

- Will my IP be managed by the TTO?

- How much say do I have in licensing decisions?

- Are there royalty-sharing agreements in place?

- Can I form a startup while employed here?

You may need to negotiate if you want to commercialize your idea independently.

7. Do it for Purpose, Not Payday

Most founders end up owning only a small percentage of their company by the time a product reaches the market. Do not expect to get rich. Do it because it solves a problem you care about. If it happens to come with a nice paycheck, then that is an added bonus.

Your clinical training and insight give you a unique edge. You already know what’s broken. Use that as your compass.

Conclusion

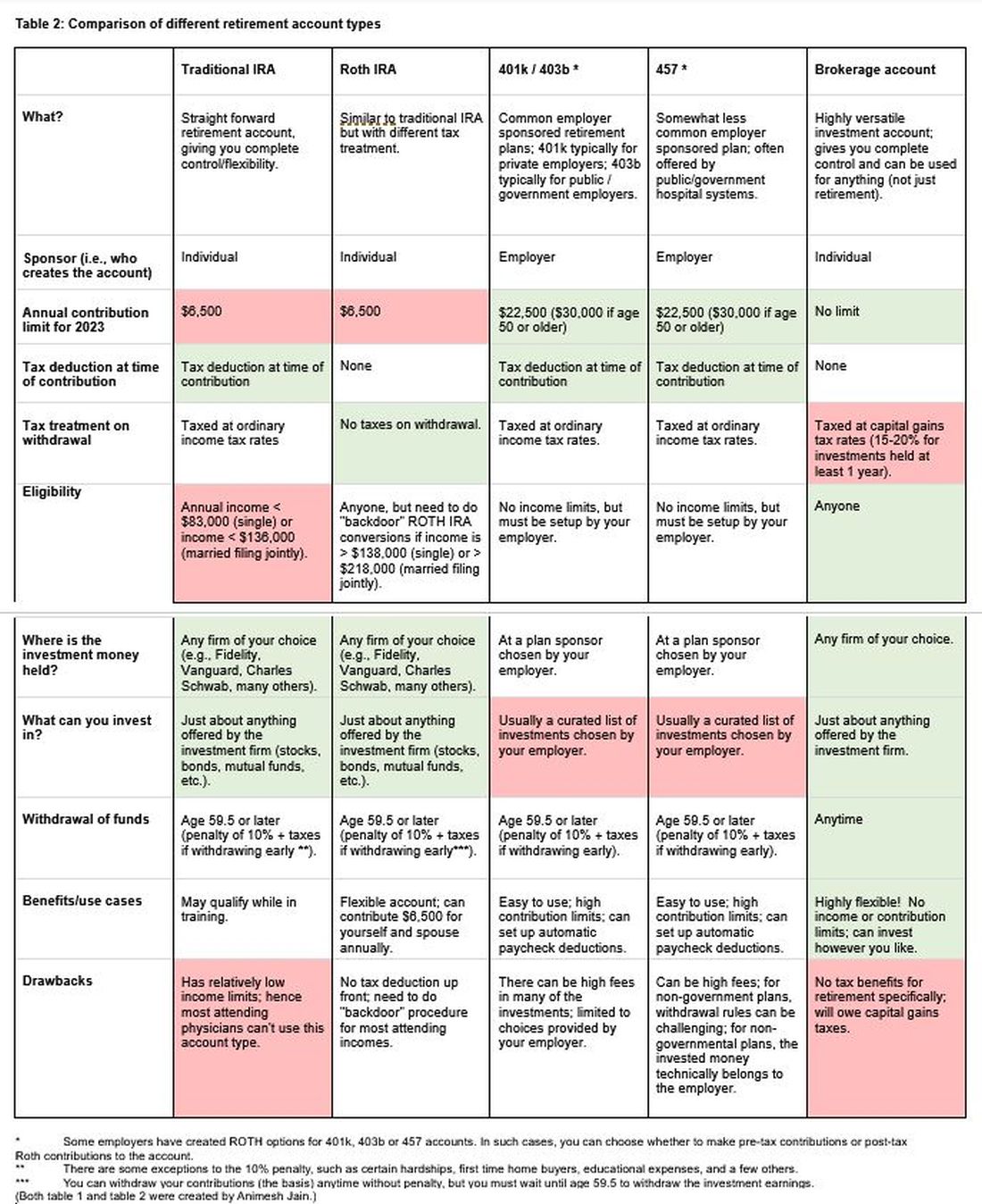

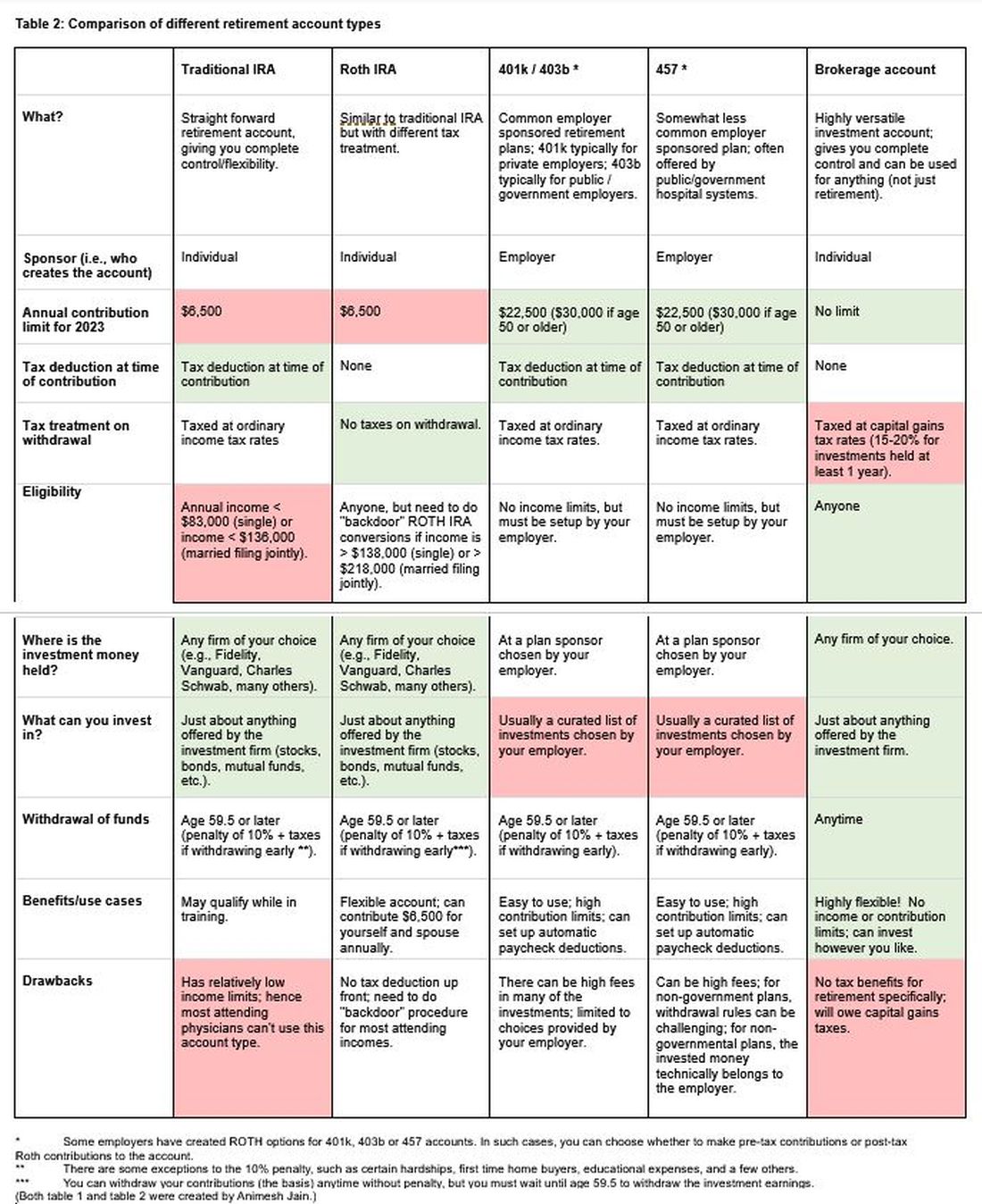

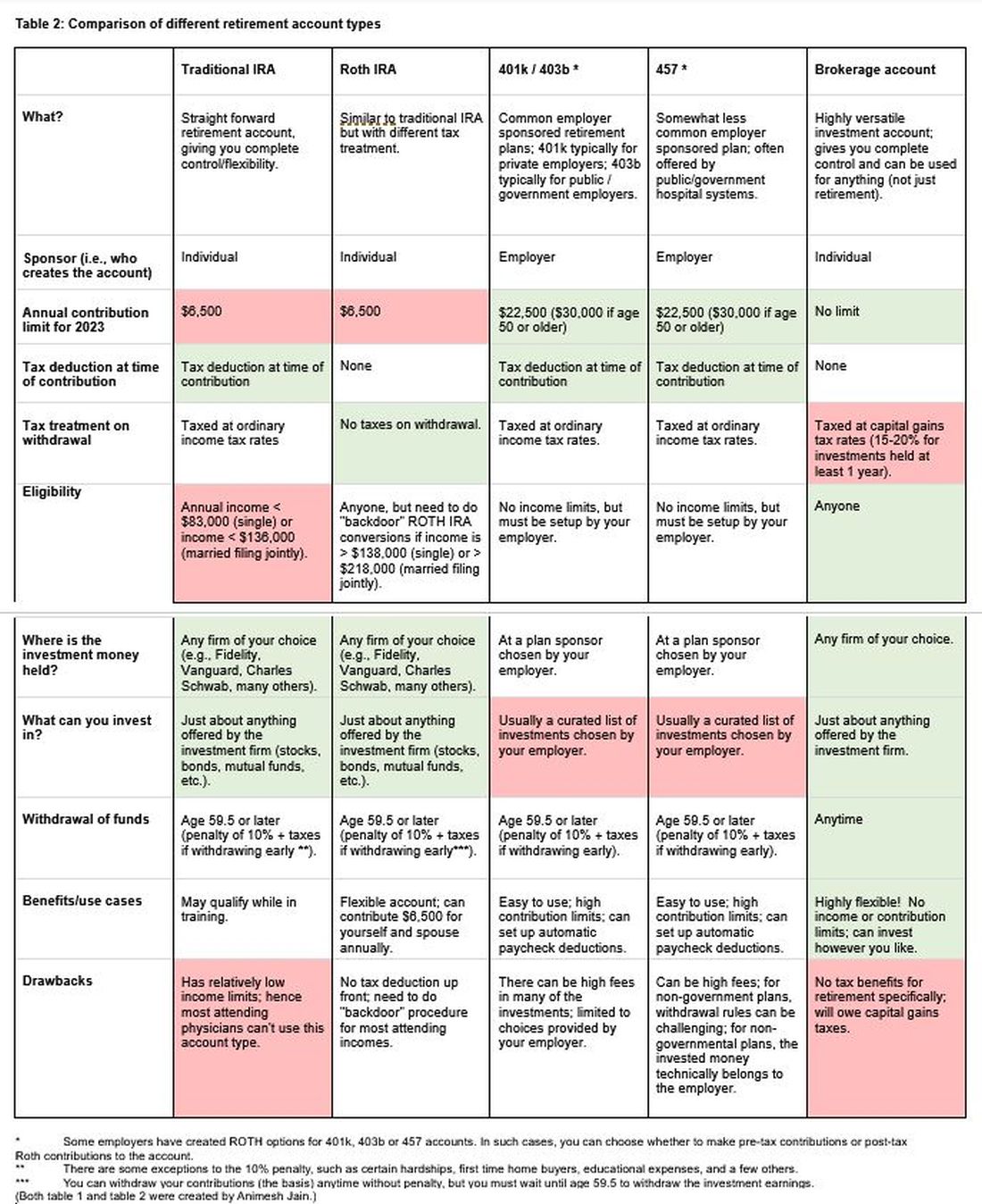

Innovation isn’t about brilliance, it’s about curiosity, structure, and tenacity (see Table 2). Start small. Protect your work. Choose the right partners. Most importantly, stay anchored in your mission to make GI care better.

Dr. Muratore is based at UNC Rex Digestive Health, Raleigh, North Carolina. She has no conflicts related to this article. Dr. Wechsler is based at the University of North Carolina at Chapel Hill, Chapel Hill, North Carolina. She holds a patent assigned to Trustees of Dartmouth College. Dr. Shah is based at the University of Michigan, Ann Arbor, Michigan. He consults for Ardelyx, Laborie, Neuraxis, Salix, Sanofi, and Takeda and holds a patent with the Regents of the University of Michigan.

You are in the middle of a busy clinic day and think, “there has to be a better way to do this.” Suddenly, a better way to do something becomes obvious. Maybe it’s a tool that simplifies documentation, a device that improves patient comfort, or an app that bridges a clinical gap. Many physicians, especially early career gastroenterologists, have ideas like this, but few know what to do next.

This article is for the curious innovator at the beginning of their clinical career. It offers practical, real-world guidance on developing a clinical product: whether that be hardware, software, or a hybrid. It outlines what questions to ask, who to consult, and how to protect your work, using personal insights and business principles learned through lived experience.

1. Understand Intellectual Property (IP): Know Its Value and Ownership

What is IP?

Intellectual property refers to your original creations: inventions, designs, software, and more. This is what you want to protect legally through patents, trademarks, or copyrights.

Who owns your idea?

This is the first and most important question to ask. If you are employed (especially by a hospital or academic center), your contract may already give your employer rights to any inventions you create, even those developed in your personal time.

What to ask:

- Does my employment contract include an “assignment of inventions” clause?

- Does the institution claim rights to anything developed with institutional resources?

- Are there moonlighting or external activity policies that affect this?

If you are developing an idea on your personal time, with your own resources, and outside your scope of clinical duties, it might still be considered “theirs” under some contracts. Early legal consultation is critical. A specialized IP attorney can help you understand what you own and how to protect it. This should be done early, ideally before you start building anything.

2. Lawyers Aren’t Optional: They’re Essential Early Partners

You do not need a full legal team, but you do need a lawyer early. An early consultation with an IP attorney can clarify your rights, guide your filing process (e.g. provisional patents), and help you avoid costly missteps.

Do this before sharing your idea publicly, including in academic presentations, pitch competitions, or even on social media. Public disclosure can start a clock ticking for application to protect your IP.

3. Build a Founding Team with Intent

Think of your startup team like a long-term relationship: you’re committing to build something together through uncertainty, tension, and change.

Strong early-stage teams often include:

- The Visionary – understands the clinical need and vision

- The Builder – engineer, developer, or designer

- The Doer – project manager or operations lead

Before forming a company, clearly define:

- Ownership (equity percentages)

- Roles and responsibilities

- Time commitments

- What happens if someone exits

Have these discussions early and document your agreements. Avoid informal “handshake” deals that can lead to serious disputes later.

4. You Don’t Need to Know Everything on Day One

You do not need to know how to write code, build a prototype, or get FDA clearance on day one. Successful innovators are humble learners. Use a Minimum Viable Product (MVP), a simple, functional version of your idea, to test assumptions and gather feedback. Iterate based on what you learn. Do not chase perfection; pursue progress. Consider using online accelerators like Y Combinator’s startup school or AGA’s Center for GI Innovation and Technology.

5. Incubators: Use them Strategically

Incubators can offer mentorship, seed funding, legal support, and technical resources, but they vary widely in value (see Table 1). Many may want equity, and not all offer when you truly need.

Ask Yourself:

- Do I need technical help, business mentorship, or just accountability?

- What does this incubator offer in terms of IP protection, exposure, and connections?

- Do I understand the equity trade-off?

- What services and funding do they provide?

- Do they take equity? How much and when?

- What’s their track record with similar ventures?

- Are their incentives aligned with your vision?

6. Academic Institutions: Partners or Pitfalls?

Universities can provide credibility, resources, and early funding through their tech transfer office (TTO).

Key Questions to Ask:

- Will my IP be managed by the TTO?

- How much say do I have in licensing decisions?

- Are there royalty-sharing agreements in place?

- Can I form a startup while employed here?

You may need to negotiate if you want to commercialize your idea independently.

7. Do it for Purpose, Not Payday

Most founders end up owning only a small percentage of their company by the time a product reaches the market. Do not expect to get rich. Do it because it solves a problem you care about. If it happens to come with a nice paycheck, then that is an added bonus.

Your clinical training and insight give you a unique edge. You already know what’s broken. Use that as your compass.

Conclusion

Innovation isn’t about brilliance, it’s about curiosity, structure, and tenacity (see Table 2). Start small. Protect your work. Choose the right partners. Most importantly, stay anchored in your mission to make GI care better.

Dr. Muratore is based at UNC Rex Digestive Health, Raleigh, North Carolina. She has no conflicts related to this article. Dr. Wechsler is based at the University of North Carolina at Chapel Hill, Chapel Hill, North Carolina. She holds a patent assigned to Trustees of Dartmouth College. Dr. Shah is based at the University of Michigan, Ann Arbor, Michigan. He consults for Ardelyx, Laborie, Neuraxis, Salix, Sanofi, and Takeda and holds a patent with the Regents of the University of Michigan.

You are in the middle of a busy clinic day and think, “there has to be a better way to do this.” Suddenly, a better way to do something becomes obvious. Maybe it’s a tool that simplifies documentation, a device that improves patient comfort, or an app that bridges a clinical gap. Many physicians, especially early career gastroenterologists, have ideas like this, but few know what to do next.

This article is for the curious innovator at the beginning of their clinical career. It offers practical, real-world guidance on developing a clinical product: whether that be hardware, software, or a hybrid. It outlines what questions to ask, who to consult, and how to protect your work, using personal insights and business principles learned through lived experience.

1. Understand Intellectual Property (IP): Know Its Value and Ownership

What is IP?

Intellectual property refers to your original creations: inventions, designs, software, and more. This is what you want to protect legally through patents, trademarks, or copyrights.

Who owns your idea?

This is the first and most important question to ask. If you are employed (especially by a hospital or academic center), your contract may already give your employer rights to any inventions you create, even those developed in your personal time.

What to ask:

- Does my employment contract include an “assignment of inventions” clause?

- Does the institution claim rights to anything developed with institutional resources?

- Are there moonlighting or external activity policies that affect this?

If you are developing an idea on your personal time, with your own resources, and outside your scope of clinical duties, it might still be considered “theirs” under some contracts. Early legal consultation is critical. A specialized IP attorney can help you understand what you own and how to protect it. This should be done early, ideally before you start building anything.

2. Lawyers Aren’t Optional: They’re Essential Early Partners

You do not need a full legal team, but you do need a lawyer early. An early consultation with an IP attorney can clarify your rights, guide your filing process (e.g. provisional patents), and help you avoid costly missteps.

Do this before sharing your idea publicly, including in academic presentations, pitch competitions, or even on social media. Public disclosure can start a clock ticking for application to protect your IP.

3. Build a Founding Team with Intent

Think of your startup team like a long-term relationship: you’re committing to build something together through uncertainty, tension, and change.

Strong early-stage teams often include:

- The Visionary – understands the clinical need and vision

- The Builder – engineer, developer, or designer

- The Doer – project manager or operations lead

Before forming a company, clearly define:

- Ownership (equity percentages)

- Roles and responsibilities

- Time commitments

- What happens if someone exits

Have these discussions early and document your agreements. Avoid informal “handshake” deals that can lead to serious disputes later.

4. You Don’t Need to Know Everything on Day One

You do not need to know how to write code, build a prototype, or get FDA clearance on day one. Successful innovators are humble learners. Use a Minimum Viable Product (MVP), a simple, functional version of your idea, to test assumptions and gather feedback. Iterate based on what you learn. Do not chase perfection; pursue progress. Consider using online accelerators like Y Combinator’s startup school or AGA’s Center for GI Innovation and Technology.

5. Incubators: Use them Strategically

Incubators can offer mentorship, seed funding, legal support, and technical resources, but they vary widely in value (see Table 1). Many may want equity, and not all offer when you truly need.

Ask Yourself:

- Do I need technical help, business mentorship, or just accountability?

- What does this incubator offer in terms of IP protection, exposure, and connections?

- Do I understand the equity trade-off?

- What services and funding do they provide?

- Do they take equity? How much and when?

- What’s their track record with similar ventures?

- Are their incentives aligned with your vision?

6. Academic Institutions: Partners or Pitfalls?

Universities can provide credibility, resources, and early funding through their tech transfer office (TTO).

Key Questions to Ask:

- Will my IP be managed by the TTO?

- How much say do I have in licensing decisions?

- Are there royalty-sharing agreements in place?

- Can I form a startup while employed here?

You may need to negotiate if you want to commercialize your idea independently.

7. Do it for Purpose, Not Payday

Most founders end up owning only a small percentage of their company by the time a product reaches the market. Do not expect to get rich. Do it because it solves a problem you care about. If it happens to come with a nice paycheck, then that is an added bonus.

Your clinical training and insight give you a unique edge. You already know what’s broken. Use that as your compass.

Conclusion

Innovation isn’t about brilliance, it’s about curiosity, structure, and tenacity (see Table 2). Start small. Protect your work. Choose the right partners. Most importantly, stay anchored in your mission to make GI care better.

Dr. Muratore is based at UNC Rex Digestive Health, Raleigh, North Carolina. She has no conflicts related to this article. Dr. Wechsler is based at the University of North Carolina at Chapel Hill, Chapel Hill, North Carolina. She holds a patent assigned to Trustees of Dartmouth College. Dr. Shah is based at the University of Michigan, Ann Arbor, Michigan. He consults for Ardelyx, Laborie, Neuraxis, Salix, Sanofi, and Takeda and holds a patent with the Regents of the University of Michigan.

Physician Compensation: Gains Small, Gaps Large

Few would deny that physicians today face many challenges: a growing and aging patient population, personnel shortages, mounting paperwork, regulatory and reimbursement pressures, and personal burnout. Collectively these could work to worsen patient access to care. Yet despite these headwinds, Doximity’s survey-based Physician Compensation Report 2025 found that more than three-quarters of physicians polled would still choose to enter their profession.

“Physician burnout isn’t new. It’s been a persistent problem over the past decade,” said Amit Phull, MD, chief clinical experience officer at Doximity. “In a Doximity poll of nearly 2,000 physicians conducted in May 2025, 85% reported they feel overworked, up from 73% just four years ago. As a result, about 68% of physicians said they are looking for an employment change or considering early retirement.”

Greater awareness of contemporary trends may help physicians make more-informed career decisions and more effectively advocate for both themselves and the patients who need them, the report’s authors stated.

Compensation Lag May Impact Care

A small overall average compensation increase of 3.7% from 2023 to 2024 – a slightly lower increase than the 5.9% in the prior year – has done little to close existing pay gaps across the profession.

In 2024, average compensation for men rose 5.7% over 2023, compared with just 1.7% for women – widening the gender pay gap to 26% vs 23% in 2023 and matching the gender gap seen in 2022. And significant disparities persist between physicians caring for adults vs children. In some specialties, the pay gap between pediatric and adult specialists exceeded 80% despite practitioners’ similar levels of training and clinical complexity.

Nearly 60% of respondents said reimbursement pressures could affect their ability to serve Medicare or Medicaid patients in the next year. Additionally, 81% reported that reimbursement policies have significantly contributed to the decline of private practices, and more than a third said they could stifle practice growth with compensation concerns forcing them to delay or cancel hiring or expansion plans. Almost 90% reported an adverse impact from physician shortages, with more citing an inability or limited ability to accept new patients.

Narrowing the Gap for Primary Care?

Over the past three years, the percent pay gap between primary care and specialist medicine declined modestly, the report noted. In 2024, surgical specialists earned 87% more than primary care physicians, down from 100% in 2022. Non-surgical specialists, emergency medicine physicians, and Ob/Gyns also continued to earn significantly more than primary care physicians, though the gaps have narrowed slightly.

“These trends come at a time when primary care remains critical to meeting high patient demand, especially amid ongoing physician shortages,” the report stated. “Primary care physicians continue to earn considerably less than many of their medical colleagues despite their essential role in the healthcare system.”

Significantly, many physicians believe that current reimbursement policies have contributed to the steady decline of independent practices in their fields. According to the American Medical Association, the share of physicians working in private practices dropped by 18 percentage points from 60.1% to 42.2% from 2012 to 2024.

The Specialties

This year’s review found that among 20 specialties, the highest average compensation occurred in surgical and procedural specialties, while the lowest paid were, as mentioned, pediatric medicine and primary care. Pediatric nephrology saw the largest average compensation growth in 2024 at 15.6%, yet compensation still lagged behind adult nephrology with a 40% pay gap.

By medical discipline, gastroenterologists ranked 13th overall in average annual compensation. Gastroenterology remained in the top 20 compensated specialties, with average annual compensation of $537,870 – an increase from $514,208 in 2024, representing a 4.5% growth rate over 2023. Neurosurgeons topped the list at $749,140, followed by thoracic surgeons at $689,969 and orthopedic surgeons at $679,517.

The three lowest-paid branches were all pediatric: endocrinology at $230,426, rheumatology at $231,574, and infectious diseases at $248,322. Pediatric gastroenterology paid somewhat higher at $298,457.

The largest disparities were seen in hematology and oncology, where adult specialists earned 93% more than their pediatric peers. Pediatric gastroenterology showed an 80% pay gap. There were also substantial pay differences across cardiology, pulmonology, and rheumatology. “These gaps appear to reflect a systemic lag in pay for pediatric specialty care, even as demand for pediatric subspecialists continues to rise,” the report stated.

Practice Setting and Location

Where a doctor practices impacts the bottom line, too: in 2024 the highest compensation reported for a metro area was in Rochester, Minnesota (the Mayo Clinic effect?), at $495,532, while the lowest reported was in Durham-Chapel Hill, North Carolina, at $368,782. St. Louis, Missouri ($484,883) and Los Angeles, California ($470,198) were 2nd and 3rd at the top of the list. Rochester, Minnesota, also emerged as best for annual compensation after cost-of-living adjustment, while Boston, Massachusetts, occupied the bottom rung.

The Gender Effect

With a women’s pay increase in 2024 of just 1.7%, the gender gap returned to its 2022-level disparity of 26%, with women physicians earning an average of $120,917 less than men after adjusting for specialty, location, and years of experience.

Doximity’s analysis of data from 2014 to 2019 estimated that on average men make at least $2 million more than women over the course of a 40-year career. This gap is often attributed to the fewer hours worked by female physician with their generally heavier familial responsibilities, “but Doximity’s gender wage gap analysis controls for the number of hours worked and career stage, along with specialty, work type, employment status, region, and credentials,” Phull said.

Women physicians had lower average earnings than men physicians across all specialties, a trend consistent with prior years. As a percentage of pay, the largest gender disparity was seen in pediatric nephrology (16.5%), a specialty that in fact saw the largest annual growth in physician pay. Neurosurgery had the smallest gender gap at 11.3%, while infectious diseases came in at 11.5% and oncology at 12%.

According to Maria T. Abreu, MD, AGAF, executive director of the F. Widjaja Inflammatory Bowel Disease Institute at Cedars-Sinai Medical Center in Los Angeles and past president of AGA, the remuneration gender gap in gastroenterology is being taken seriously by AGA and several other GI societies. “The discrepancies in pay start from the beginning and therefore are magnified over time. We are helping to empower women to negotiate better as well as to gather data on the roots of inequity, she told GI & Hepatology News.

The AGA Women’s Committee has developed a project to support the advancement of women in gastroenterology, Abreu said. The initiative, which includes the AGA Gender Equity Framework and Gender Equity Road Map. focuses attention on disparities in the workplace and promotes opportunities for women’s leadership, career advancement, mentorship and physician health and wellness, she added.

Are these disparities due mainly to the “motherhood penalty,” with career interruption and time lost to maternity leave and fewer hours worked owing to the greater parenting burden of physician mothers? Or are they due to the systemic effects of gender expectations around compensation?

Hours worked appear to be a factor. A 2017 study of dual physician couples found that among childless respondents men worked an average of 57 hours and women 52 hours weekly. Compared with childless men, men with children worked similar numbers of hours weekly. However, compared with childless physicians, mothers worked significantly fewer hours – roughly 40 to 43 hours weekly – depending on the age of their youngest child.

Abreu pushed back on this stereotype. “Most women physicians, including gastroenterologists, do not take the maternity leave they are allowed because they are concerned about burdening their colleagues,” she said. “Thus, it is unlikely to explain the disparities. Many systemic issues remain challenging, but we want women to be empowered to advocate for themselves at the time of hiring and along the arc of their career paths.”

In Abreu’s view, having women assume more leadership roles in the field of gastroenterology provides an opportunity to focus on reducing the disparities in compensation.

Regardless of gender, among all physicians surveyed, autonomy and work-life balance appeared to be a high priority: 77% of doctors said they would be willing to accept or have already accepted lower pay for more autonomy or work-life balance. “Overwork appears to be especially prevalent among women physicians,” said Phull, noting that 91% of women respondents reported being overworked compared with 80% of men. “This overwork has compelled 74% of women to consider making a career change, compared with 62% of men.” Differences emerged among specialties as well: 90% of primary care physicians said they are overworked compared with 84% of surgeons and 83% of non-surgical specialists.

Looking ahead, the report raised an important question. Are we relying too heavily on physicians rather than addressing the underlying need for policies that support a healthier, more sustainable future for all? “Building that future will take more than physician dedication alone,” Phull said. “It will require meaningful collaboration across the entire health care ecosystem – including health systems, hospitals, payors, and policymakers. And physicians must not only have a voice in shaping the path forward; they must have a seat at the table.”

Abreu reported no conflicts of interest in regard to her comments.

Few would deny that physicians today face many challenges: a growing and aging patient population, personnel shortages, mounting paperwork, regulatory and reimbursement pressures, and personal burnout. Collectively these could work to worsen patient access to care. Yet despite these headwinds, Doximity’s survey-based Physician Compensation Report 2025 found that more than three-quarters of physicians polled would still choose to enter their profession.

“Physician burnout isn’t new. It’s been a persistent problem over the past decade,” said Amit Phull, MD, chief clinical experience officer at Doximity. “In a Doximity poll of nearly 2,000 physicians conducted in May 2025, 85% reported they feel overworked, up from 73% just four years ago. As a result, about 68% of physicians said they are looking for an employment change or considering early retirement.”

Greater awareness of contemporary trends may help physicians make more-informed career decisions and more effectively advocate for both themselves and the patients who need them, the report’s authors stated.

Compensation Lag May Impact Care

A small overall average compensation increase of 3.7% from 2023 to 2024 – a slightly lower increase than the 5.9% in the prior year – has done little to close existing pay gaps across the profession.

In 2024, average compensation for men rose 5.7% over 2023, compared with just 1.7% for women – widening the gender pay gap to 26% vs 23% in 2023 and matching the gender gap seen in 2022. And significant disparities persist between physicians caring for adults vs children. In some specialties, the pay gap between pediatric and adult specialists exceeded 80% despite practitioners’ similar levels of training and clinical complexity.

Nearly 60% of respondents said reimbursement pressures could affect their ability to serve Medicare or Medicaid patients in the next year. Additionally, 81% reported that reimbursement policies have significantly contributed to the decline of private practices, and more than a third said they could stifle practice growth with compensation concerns forcing them to delay or cancel hiring or expansion plans. Almost 90% reported an adverse impact from physician shortages, with more citing an inability or limited ability to accept new patients.

Narrowing the Gap for Primary Care?

Over the past three years, the percent pay gap between primary care and specialist medicine declined modestly, the report noted. In 2024, surgical specialists earned 87% more than primary care physicians, down from 100% in 2022. Non-surgical specialists, emergency medicine physicians, and Ob/Gyns also continued to earn significantly more than primary care physicians, though the gaps have narrowed slightly.

“These trends come at a time when primary care remains critical to meeting high patient demand, especially amid ongoing physician shortages,” the report stated. “Primary care physicians continue to earn considerably less than many of their medical colleagues despite their essential role in the healthcare system.”

Significantly, many physicians believe that current reimbursement policies have contributed to the steady decline of independent practices in their fields. According to the American Medical Association, the share of physicians working in private practices dropped by 18 percentage points from 60.1% to 42.2% from 2012 to 2024.

The Specialties

This year’s review found that among 20 specialties, the highest average compensation occurred in surgical and procedural specialties, while the lowest paid were, as mentioned, pediatric medicine and primary care. Pediatric nephrology saw the largest average compensation growth in 2024 at 15.6%, yet compensation still lagged behind adult nephrology with a 40% pay gap.

By medical discipline, gastroenterologists ranked 13th overall in average annual compensation. Gastroenterology remained in the top 20 compensated specialties, with average annual compensation of $537,870 – an increase from $514,208 in 2024, representing a 4.5% growth rate over 2023. Neurosurgeons topped the list at $749,140, followed by thoracic surgeons at $689,969 and orthopedic surgeons at $679,517.

The three lowest-paid branches were all pediatric: endocrinology at $230,426, rheumatology at $231,574, and infectious diseases at $248,322. Pediatric gastroenterology paid somewhat higher at $298,457.

The largest disparities were seen in hematology and oncology, where adult specialists earned 93% more than their pediatric peers. Pediatric gastroenterology showed an 80% pay gap. There were also substantial pay differences across cardiology, pulmonology, and rheumatology. “These gaps appear to reflect a systemic lag in pay for pediatric specialty care, even as demand for pediatric subspecialists continues to rise,” the report stated.

Practice Setting and Location

Where a doctor practices impacts the bottom line, too: in 2024 the highest compensation reported for a metro area was in Rochester, Minnesota (the Mayo Clinic effect?), at $495,532, while the lowest reported was in Durham-Chapel Hill, North Carolina, at $368,782. St. Louis, Missouri ($484,883) and Los Angeles, California ($470,198) were 2nd and 3rd at the top of the list. Rochester, Minnesota, also emerged as best for annual compensation after cost-of-living adjustment, while Boston, Massachusetts, occupied the bottom rung.

The Gender Effect

With a women’s pay increase in 2024 of just 1.7%, the gender gap returned to its 2022-level disparity of 26%, with women physicians earning an average of $120,917 less than men after adjusting for specialty, location, and years of experience.

Doximity’s analysis of data from 2014 to 2019 estimated that on average men make at least $2 million more than women over the course of a 40-year career. This gap is often attributed to the fewer hours worked by female physician with their generally heavier familial responsibilities, “but Doximity’s gender wage gap analysis controls for the number of hours worked and career stage, along with specialty, work type, employment status, region, and credentials,” Phull said.

Women physicians had lower average earnings than men physicians across all specialties, a trend consistent with prior years. As a percentage of pay, the largest gender disparity was seen in pediatric nephrology (16.5%), a specialty that in fact saw the largest annual growth in physician pay. Neurosurgery had the smallest gender gap at 11.3%, while infectious diseases came in at 11.5% and oncology at 12%.

According to Maria T. Abreu, MD, AGAF, executive director of the F. Widjaja Inflammatory Bowel Disease Institute at Cedars-Sinai Medical Center in Los Angeles and past president of AGA, the remuneration gender gap in gastroenterology is being taken seriously by AGA and several other GI societies. “The discrepancies in pay start from the beginning and therefore are magnified over time. We are helping to empower women to negotiate better as well as to gather data on the roots of inequity, she told GI & Hepatology News.

The AGA Women’s Committee has developed a project to support the advancement of women in gastroenterology, Abreu said. The initiative, which includes the AGA Gender Equity Framework and Gender Equity Road Map. focuses attention on disparities in the workplace and promotes opportunities for women’s leadership, career advancement, mentorship and physician health and wellness, she added.

Are these disparities due mainly to the “motherhood penalty,” with career interruption and time lost to maternity leave and fewer hours worked owing to the greater parenting burden of physician mothers? Or are they due to the systemic effects of gender expectations around compensation?

Hours worked appear to be a factor. A 2017 study of dual physician couples found that among childless respondents men worked an average of 57 hours and women 52 hours weekly. Compared with childless men, men with children worked similar numbers of hours weekly. However, compared with childless physicians, mothers worked significantly fewer hours – roughly 40 to 43 hours weekly – depending on the age of their youngest child.

Abreu pushed back on this stereotype. “Most women physicians, including gastroenterologists, do not take the maternity leave they are allowed because they are concerned about burdening their colleagues,” she said. “Thus, it is unlikely to explain the disparities. Many systemic issues remain challenging, but we want women to be empowered to advocate for themselves at the time of hiring and along the arc of their career paths.”

In Abreu’s view, having women assume more leadership roles in the field of gastroenterology provides an opportunity to focus on reducing the disparities in compensation.

Regardless of gender, among all physicians surveyed, autonomy and work-life balance appeared to be a high priority: 77% of doctors said they would be willing to accept or have already accepted lower pay for more autonomy or work-life balance. “Overwork appears to be especially prevalent among women physicians,” said Phull, noting that 91% of women respondents reported being overworked compared with 80% of men. “This overwork has compelled 74% of women to consider making a career change, compared with 62% of men.” Differences emerged among specialties as well: 90% of primary care physicians said they are overworked compared with 84% of surgeons and 83% of non-surgical specialists.

Looking ahead, the report raised an important question. Are we relying too heavily on physicians rather than addressing the underlying need for policies that support a healthier, more sustainable future for all? “Building that future will take more than physician dedication alone,” Phull said. “It will require meaningful collaboration across the entire health care ecosystem – including health systems, hospitals, payors, and policymakers. And physicians must not only have a voice in shaping the path forward; they must have a seat at the table.”

Abreu reported no conflicts of interest in regard to her comments.

Few would deny that physicians today face many challenges: a growing and aging patient population, personnel shortages, mounting paperwork, regulatory and reimbursement pressures, and personal burnout. Collectively these could work to worsen patient access to care. Yet despite these headwinds, Doximity’s survey-based Physician Compensation Report 2025 found that more than three-quarters of physicians polled would still choose to enter their profession.

“Physician burnout isn’t new. It’s been a persistent problem over the past decade,” said Amit Phull, MD, chief clinical experience officer at Doximity. “In a Doximity poll of nearly 2,000 physicians conducted in May 2025, 85% reported they feel overworked, up from 73% just four years ago. As a result, about 68% of physicians said they are looking for an employment change or considering early retirement.”

Greater awareness of contemporary trends may help physicians make more-informed career decisions and more effectively advocate for both themselves and the patients who need them, the report’s authors stated.

Compensation Lag May Impact Care

A small overall average compensation increase of 3.7% from 2023 to 2024 – a slightly lower increase than the 5.9% in the prior year – has done little to close existing pay gaps across the profession.

In 2024, average compensation for men rose 5.7% over 2023, compared with just 1.7% for women – widening the gender pay gap to 26% vs 23% in 2023 and matching the gender gap seen in 2022. And significant disparities persist between physicians caring for adults vs children. In some specialties, the pay gap between pediatric and adult specialists exceeded 80% despite practitioners’ similar levels of training and clinical complexity.

Nearly 60% of respondents said reimbursement pressures could affect their ability to serve Medicare or Medicaid patients in the next year. Additionally, 81% reported that reimbursement policies have significantly contributed to the decline of private practices, and more than a third said they could stifle practice growth with compensation concerns forcing them to delay or cancel hiring or expansion plans. Almost 90% reported an adverse impact from physician shortages, with more citing an inability or limited ability to accept new patients.

Narrowing the Gap for Primary Care?

Over the past three years, the percent pay gap between primary care and specialist medicine declined modestly, the report noted. In 2024, surgical specialists earned 87% more than primary care physicians, down from 100% in 2022. Non-surgical specialists, emergency medicine physicians, and Ob/Gyns also continued to earn significantly more than primary care physicians, though the gaps have narrowed slightly.

“These trends come at a time when primary care remains critical to meeting high patient demand, especially amid ongoing physician shortages,” the report stated. “Primary care physicians continue to earn considerably less than many of their medical colleagues despite their essential role in the healthcare system.”

Significantly, many physicians believe that current reimbursement policies have contributed to the steady decline of independent practices in their fields. According to the American Medical Association, the share of physicians working in private practices dropped by 18 percentage points from 60.1% to 42.2% from 2012 to 2024.

The Specialties

This year’s review found that among 20 specialties, the highest average compensation occurred in surgical and procedural specialties, while the lowest paid were, as mentioned, pediatric medicine and primary care. Pediatric nephrology saw the largest average compensation growth in 2024 at 15.6%, yet compensation still lagged behind adult nephrology with a 40% pay gap.

By medical discipline, gastroenterologists ranked 13th overall in average annual compensation. Gastroenterology remained in the top 20 compensated specialties, with average annual compensation of $537,870 – an increase from $514,208 in 2024, representing a 4.5% growth rate over 2023. Neurosurgeons topped the list at $749,140, followed by thoracic surgeons at $689,969 and orthopedic surgeons at $679,517.

The three lowest-paid branches were all pediatric: endocrinology at $230,426, rheumatology at $231,574, and infectious diseases at $248,322. Pediatric gastroenterology paid somewhat higher at $298,457.

The largest disparities were seen in hematology and oncology, where adult specialists earned 93% more than their pediatric peers. Pediatric gastroenterology showed an 80% pay gap. There were also substantial pay differences across cardiology, pulmonology, and rheumatology. “These gaps appear to reflect a systemic lag in pay for pediatric specialty care, even as demand for pediatric subspecialists continues to rise,” the report stated.

Practice Setting and Location

Where a doctor practices impacts the bottom line, too: in 2024 the highest compensation reported for a metro area was in Rochester, Minnesota (the Mayo Clinic effect?), at $495,532, while the lowest reported was in Durham-Chapel Hill, North Carolina, at $368,782. St. Louis, Missouri ($484,883) and Los Angeles, California ($470,198) were 2nd and 3rd at the top of the list. Rochester, Minnesota, also emerged as best for annual compensation after cost-of-living adjustment, while Boston, Massachusetts, occupied the bottom rung.

The Gender Effect

With a women’s pay increase in 2024 of just 1.7%, the gender gap returned to its 2022-level disparity of 26%, with women physicians earning an average of $120,917 less than men after adjusting for specialty, location, and years of experience.

Doximity’s analysis of data from 2014 to 2019 estimated that on average men make at least $2 million more than women over the course of a 40-year career. This gap is often attributed to the fewer hours worked by female physician with their generally heavier familial responsibilities, “but Doximity’s gender wage gap analysis controls for the number of hours worked and career stage, along with specialty, work type, employment status, region, and credentials,” Phull said.

Women physicians had lower average earnings than men physicians across all specialties, a trend consistent with prior years. As a percentage of pay, the largest gender disparity was seen in pediatric nephrology (16.5%), a specialty that in fact saw the largest annual growth in physician pay. Neurosurgery had the smallest gender gap at 11.3%, while infectious diseases came in at 11.5% and oncology at 12%.

According to Maria T. Abreu, MD, AGAF, executive director of the F. Widjaja Inflammatory Bowel Disease Institute at Cedars-Sinai Medical Center in Los Angeles and past president of AGA, the remuneration gender gap in gastroenterology is being taken seriously by AGA and several other GI societies. “The discrepancies in pay start from the beginning and therefore are magnified over time. We are helping to empower women to negotiate better as well as to gather data on the roots of inequity, she told GI & Hepatology News.

The AGA Women’s Committee has developed a project to support the advancement of women in gastroenterology, Abreu said. The initiative, which includes the AGA Gender Equity Framework and Gender Equity Road Map. focuses attention on disparities in the workplace and promotes opportunities for women’s leadership, career advancement, mentorship and physician health and wellness, she added.

Are these disparities due mainly to the “motherhood penalty,” with career interruption and time lost to maternity leave and fewer hours worked owing to the greater parenting burden of physician mothers? Or are they due to the systemic effects of gender expectations around compensation?

Hours worked appear to be a factor. A 2017 study of dual physician couples found that among childless respondents men worked an average of 57 hours and women 52 hours weekly. Compared with childless men, men with children worked similar numbers of hours weekly. However, compared with childless physicians, mothers worked significantly fewer hours – roughly 40 to 43 hours weekly – depending on the age of their youngest child.

Abreu pushed back on this stereotype. “Most women physicians, including gastroenterologists, do not take the maternity leave they are allowed because they are concerned about burdening their colleagues,” she said. “Thus, it is unlikely to explain the disparities. Many systemic issues remain challenging, but we want women to be empowered to advocate for themselves at the time of hiring and along the arc of their career paths.”

In Abreu’s view, having women assume more leadership roles in the field of gastroenterology provides an opportunity to focus on reducing the disparities in compensation.

Regardless of gender, among all physicians surveyed, autonomy and work-life balance appeared to be a high priority: 77% of doctors said they would be willing to accept or have already accepted lower pay for more autonomy or work-life balance. “Overwork appears to be especially prevalent among women physicians,” said Phull, noting that 91% of women respondents reported being overworked compared with 80% of men. “This overwork has compelled 74% of women to consider making a career change, compared with 62% of men.” Differences emerged among specialties as well: 90% of primary care physicians said they are overworked compared with 84% of surgeons and 83% of non-surgical specialists.

Looking ahead, the report raised an important question. Are we relying too heavily on physicians rather than addressing the underlying need for policies that support a healthier, more sustainable future for all? “Building that future will take more than physician dedication alone,” Phull said. “It will require meaningful collaboration across the entire health care ecosystem – including health systems, hospitals, payors, and policymakers. And physicians must not only have a voice in shaping the path forward; they must have a seat at the table.”

Abreu reported no conflicts of interest in regard to her comments.

Medical Liability for the Gastroenterologist

While nearly 75% of physicians in low-risk specialties and 99% of physicians in high-risk specialties may face a malpractice claim in their careers,1 malpractice is rarely discussed openly in medical school, residency, fellowship, or even amongst colleagues. Indeed, one study suggested that more than 10% of practicing gastroenterologists may face a malpractice claim,2 with gastroenterologists expected to spend 10-15% of their careers with an outstanding malpractice claim3 as cases may take 27-29 months to resolve on average.4

Believing that if a physician is sued, one must have done something “wrong” or that speaking about one’s experience may implicate a colleague, creates an intense stigma and isolation that only serves to aggravate the “second victim syndrome” (SVS) that is well documented in the surgical literature.2 Herein,

What is Malpractice? Why Do Physicians Get Sued?

Malpractice is defined as negligence on the part of a physician which causes physical or emotional damage to the patient. This requires a variety of legal issues to be evaluated (e.g. breach of duty between the physicians and patient, breach of standard of care), that often center around the question: would a “reasonable, careful, and prudent” doctor behave in the same manner in the same circumstance?

While some fields of medicine lend themselves better to algorithmic applications of highly evidence-based guidelines, many aspects of GI care and endoscopic practice are highly physician/patient-specific, dependent on local expertise, and based on low-quality evidence. As a result, an assessment of negligence may be quite subjective, depending on the expert retained by a plaintiff. Conflicting expert testimony on what professional custom is and whether practice deviates may hinge on technical details that may or may not be appreciated by a lay jury.

Plaintiffs must prove both that they have sustained an injury and that the injury (emotional or physical) was due to the physician’s negligence. While this may be straightforward in a “slip-and-fall” tort claim, medical malpractice claims usually involve sick patients with multiple comorbidities, where assigning causality to a single intervention/misinterpretation/missed opportunity is difficult to weigh against competing causes of adverse outcomes. Assessing a specific liability requires that the plaintiff prove this to a “more likely than not” standard which may be part of the reason why only 30% of cases are closed with indemnity payments, a figure that has not changed significantly in the past decade.4

While the perception amongst physicians is that tort legislation is ever increasing, data from the National Practitioner Data Bank (NPDB) demonstrates that the number of paid claims against physicians has decreased by 75% in the last 20 years.5 This may reflect a progressive improvement in the quality of care delivered or success of “tort reform” on the state level to limit damages and “nuisance” lawsuits. However, another more problematic possibility is that with the corporatization of medicine, an untold number of physicians may be removed from litigation as a named party, with their institution shielding them from reporting. While the number of cases may or may not be declining, the average indemnity payment appears to be rising to $330,000 on average,4 with one study suggesting a significant growth in paid claims in gastroenterology.6

Historically, studies of closed malpractice claims have demonstrated that 59% involved diagnostic errors involving a cancer diagnosis,7 though why this actually happens may be for a wide variety of reasons including errors in the development of a differential diagnosis, ordering of an appropriate diagnostic test, interpretation of the diagnostic test, or follow-up of an abnormality identified.

What are the Intended/Unintended Consequences of Litigation?

The objective of our tort system is to compensate patients for economic damages (medical costs and lost wages) and non-economic damages (pain and suffering), and to ideally deter negligent behavior of providers. Interestingly, data from the NPDB have suggested that approximately 1% of all physicians account for 32% of all paid claims, with the same study showing that among physicians with paid claims, 4% had at least 3.8

While certain fields are obviously more prone to litigation, the risk of additional claims on a physician with 3 prior claims was more than 3 times that of physicians with 1 lifetime claim. One would assume that the system was built to drive out a small proportion of “bad actors.” Indeed, similar data from the NPDB has demonstrated that the number of claims against physicians was associated both with their leaving the practice of medicine and relocating to smaller practice settings.9

Another frequent question is whether the threat of litigation drives “defensive medicine” (i.e. medical care that is not beneficial) or avoidance medicine (i.e. excluding high risk patients and procedures from ones’ practice). These behaviors have been well documented in physicians around the world,10 as well as several surveys of gastroenterologists specifically suggesting regular ordering of unnecessary imaging/endoscopy and referrals of patients to specialists that may not be necessary.11,12

However, does defensive medicine work: does spending more prevent you from being the target of a lawsuit? In an observational study in Florida from 2000-2009, researchers demonstrated that across specialties, greater average spending by physicians was associated with a reduced risk of incurring a malpractice claim. Indeed, the likelihood of a top quintile spending internist having a malpractice incident vs a bottom quintile spending internist was 0.3% vs 1.5%.13

Approximately 10.4-43.3% of physicians may experience SVS, experiencing trauma after an adverse patient event/medical error, manifesting with psychological trauma (shame, guilt, anxiety) and cognitive limitations (burnout, stress).2 Significant emotional consequences are common on the part of the physician and have well-documented stages to recovery,14 which if ignored may lead to long-term detrimental mental/emotional health of the physician and their future patients.

Specifically, in one study, 80.8% of physicians who had a closed malpractice claim reported significant emotional distress (regardless of the legal outcome), with frequent reports of mood symptoms that affected professional conduct.15 Recognizing these effects and implementing peer counseling and institutional support may help to expedite recovery and mitigate future adverse career outcomes.14

Anatomy/Timeline of a Liability Lawsuit

Medical malpractice cases are heard in state courts, in the jurisdictions where the care was provided. From the time an event occurs to when a jury verdict may be rendered may take 4-5 years or more depending on the local statute of limitations, discovery process, backlog of the local case docket, and specific circumstances of the case. The length of time is important to consider given the likelihood that a physician may advance in training or move practice locations during the course of litigation. Several common myths surrounding this process are summarized in the accompanying box, titled “Myths Surrounding Medical Liability Litigation.”

The plaintiff faces a statute of limitations to file a lawsuit that may range from 1-6 years depending on the state. The first indication that legal action may be pending will generally be a plaintiff’s formal request for medical records. After these records are reviewed, the plaintiff’s attorney will consult one or more experts (often credentialed in the same specialty) to assess if the case is viable and to ultimately form the basis of an affidavit of merit from a plaintiff expert.

Once the lawsuit is filed, the physician(s) named will be assigned an attorney by their employer/insurance company. A state medical board malpractice questionnaire will generally follow that will seek to independently evaluate the alleged malpractice with interrogatives to determine if censure is warranted. There is a formal response to the plaintiff’s petition by the defense and then the discovery phase begins where both sides depose the defendants/plaintiffs and retain medical experts that are favorable to their arguments.

In choosing potential “experts,” physicians must ensure that they are willing/able to be present for a potential trial, do not have any personal/professional/academic conflicts with the defendants, and are willing to provide compelling testimony to a jury. A pre-trial conference and trial date is set which may be >12 months away depending on the local docket. While the amount of time a trial may take is variable, it may be up to 5-7 days that the defendants are expected to be in court in addition to days where depositions are being taken.

During the discovery process, dismissal of the physician from the lawsuit is pursued. In addition, settlement negotiations generally proceed in parallel with discovery process and may result in a pre-trial/pre-verdict settlement. Once a verdict is reached, whether for the plaintiff or the defendant, the case may be appealed, and the trial preparation process may be repeated.

Conclusions

Awareness of the medical liability process is critical for trainees and attendings alike, given the high likelihood of litigation in a gastroenterologist’s career. Specific considerations like local tort law and malpractice coverage are important to be familiar. Ongoing health services research help to shape our understanding on the intended and unintended consequences of litigation on medicine, though detailed data on outcomes/settlements are limited by confidentiality agreements, which may hamper efforts to improve patient safety.

Dr. Das is associate professor of medicine in the Division of Gastroenterology at Washington University School of Medicine, St. Louis, Missouri. He has served as a consultant for Olympus, but has no other relevant conflicts.

References

1. Jena AB, et al. Malpractice Risk According to Physician Specialty. N Engl J Med. 2011 Aug. doi: 10.1056/NEJMsa1012370.

2. Chong RIH, et al. Scoping review of the second victim syndrome among surgeons: Understanding the impact, responses, and support systems. Am J Surg 2024 Mar. doi: 10.1016/j.amjsurg.2023.09.045.

3. Seabury S, et al. On Average, Physicians Spend Nearly 11 Percent Of Their 40-Year Careers With An Open, Unresolved Malpractice Claim. Health Aff Proj Hope. 2013 Jan. doi: 10.1377/hlthaff.2012.0967.

4. CRICO Strategies. Medical Malpractice in America: A 10-Year Asessment with Insights. 2018. Accessed Apr 28, 2025.

5. Studdert DM, Hall MA. Medical Malpractice Law — Doctrine and Dynamics. N Engl J Med 2022 Oct. doi: 10.1056/NEJMp2201675.

6. Schaffer AC, et al. Rates and Characteristics of Paid Malpractice Claims Among US Physicians by Specialty, 1992-2014. JAMA Intern Med. 2017 May. doi: 10.1001/jamainternmed.2017.0311.

7. Gandhi TK, et al. Missed and Delayed Diagnoses in the Ambulatory Setting: A Study of Closed Malpractice Claims. Ann Intern Med. 2006 Oct. doi: 10.7326/0003-4819-145-7-200610030-00006.

8. Studdert DM, et al. Prevalence and Characteristics of Physicians Prone to Malpractice Claims. N Engl J Med. 2016 Jan. doi: 10.1056/NEJMsa1506137.

9. Studdert DM, et al. Changes in Practice among Physicians with Malpractice Claims. N Engl J Med. 2019 Mar. doi: 10.1056/NEJMsa1809981.

10. Ries NM, Jansen J. Physicians’ views and experiences of defensive medicine: An international review of empirical research. Health Policy. 2021 May. doi: 10.1016/j.healthpol.2021.02.005.

11. Hiyama T, et al. Defensive medicine practices among gastroenterologists in Japan. World J Gastroenterol. 2006 Dec. doi: 10.3748/wjg.v12.i47.7671.

12. Elli L, et al. Defensive medicine practices among gastroenterologists in Lombardy: Between lawsuits and the economic crisis. Dig Liver Dis. 2013 Jun. doi: 10.1016/j.dld.2013.01.004.

13. Jena AB, et al. Physician spending and subsequent risk of malpractice claims: observational study. BMJ. 2015 Nov. doi: 10.1136/bmj.h5516.

14. Scott SD, et al. The natural history of recovery for the healthcare provider “second victim” after adverse patient events. BMJ Qual Saf. 2009 Oct. doi: 10.1136/qshc.2009.032870.

15. Gómez-Durán EL, et al. Physicians as second victims after a malpractice claim: An important issue in need of attention. J Healthc Qual Res. 2018 Oct. doi: 10.1016/j.jhqr.2018.06.002.

While nearly 75% of physicians in low-risk specialties and 99% of physicians in high-risk specialties may face a malpractice claim in their careers,1 malpractice is rarely discussed openly in medical school, residency, fellowship, or even amongst colleagues. Indeed, one study suggested that more than 10% of practicing gastroenterologists may face a malpractice claim,2 with gastroenterologists expected to spend 10-15% of their careers with an outstanding malpractice claim3 as cases may take 27-29 months to resolve on average.4

Believing that if a physician is sued, one must have done something “wrong” or that speaking about one’s experience may implicate a colleague, creates an intense stigma and isolation that only serves to aggravate the “second victim syndrome” (SVS) that is well documented in the surgical literature.2 Herein,

What is Malpractice? Why Do Physicians Get Sued?

Malpractice is defined as negligence on the part of a physician which causes physical or emotional damage to the patient. This requires a variety of legal issues to be evaluated (e.g. breach of duty between the physicians and patient, breach of standard of care), that often center around the question: would a “reasonable, careful, and prudent” doctor behave in the same manner in the same circumstance?

While some fields of medicine lend themselves better to algorithmic applications of highly evidence-based guidelines, many aspects of GI care and endoscopic practice are highly physician/patient-specific, dependent on local expertise, and based on low-quality evidence. As a result, an assessment of negligence may be quite subjective, depending on the expert retained by a plaintiff. Conflicting expert testimony on what professional custom is and whether practice deviates may hinge on technical details that may or may not be appreciated by a lay jury.

Plaintiffs must prove both that they have sustained an injury and that the injury (emotional or physical) was due to the physician’s negligence. While this may be straightforward in a “slip-and-fall” tort claim, medical malpractice claims usually involve sick patients with multiple comorbidities, where assigning causality to a single intervention/misinterpretation/missed opportunity is difficult to weigh against competing causes of adverse outcomes. Assessing a specific liability requires that the plaintiff prove this to a “more likely than not” standard which may be part of the reason why only 30% of cases are closed with indemnity payments, a figure that has not changed significantly in the past decade.4

While the perception amongst physicians is that tort legislation is ever increasing, data from the National Practitioner Data Bank (NPDB) demonstrates that the number of paid claims against physicians has decreased by 75% in the last 20 years.5 This may reflect a progressive improvement in the quality of care delivered or success of “tort reform” on the state level to limit damages and “nuisance” lawsuits. However, another more problematic possibility is that with the corporatization of medicine, an untold number of physicians may be removed from litigation as a named party, with their institution shielding them from reporting. While the number of cases may or may not be declining, the average indemnity payment appears to be rising to $330,000 on average,4 with one study suggesting a significant growth in paid claims in gastroenterology.6

Historically, studies of closed malpractice claims have demonstrated that 59% involved diagnostic errors involving a cancer diagnosis,7 though why this actually happens may be for a wide variety of reasons including errors in the development of a differential diagnosis, ordering of an appropriate diagnostic test, interpretation of the diagnostic test, or follow-up of an abnormality identified.

What are the Intended/Unintended Consequences of Litigation?

The objective of our tort system is to compensate patients for economic damages (medical costs and lost wages) and non-economic damages (pain and suffering), and to ideally deter negligent behavior of providers. Interestingly, data from the NPDB have suggested that approximately 1% of all physicians account for 32% of all paid claims, with the same study showing that among physicians with paid claims, 4% had at least 3.8

While certain fields are obviously more prone to litigation, the risk of additional claims on a physician with 3 prior claims was more than 3 times that of physicians with 1 lifetime claim. One would assume that the system was built to drive out a small proportion of “bad actors.” Indeed, similar data from the NPDB has demonstrated that the number of claims against physicians was associated both with their leaving the practice of medicine and relocating to smaller practice settings.9

Another frequent question is whether the threat of litigation drives “defensive medicine” (i.e. medical care that is not beneficial) or avoidance medicine (i.e. excluding high risk patients and procedures from ones’ practice). These behaviors have been well documented in physicians around the world,10 as well as several surveys of gastroenterologists specifically suggesting regular ordering of unnecessary imaging/endoscopy and referrals of patients to specialists that may not be necessary.11,12

However, does defensive medicine work: does spending more prevent you from being the target of a lawsuit? In an observational study in Florida from 2000-2009, researchers demonstrated that across specialties, greater average spending by physicians was associated with a reduced risk of incurring a malpractice claim. Indeed, the likelihood of a top quintile spending internist having a malpractice incident vs a bottom quintile spending internist was 0.3% vs 1.5%.13

Approximately 10.4-43.3% of physicians may experience SVS, experiencing trauma after an adverse patient event/medical error, manifesting with psychological trauma (shame, guilt, anxiety) and cognitive limitations (burnout, stress).2 Significant emotional consequences are common on the part of the physician and have well-documented stages to recovery,14 which if ignored may lead to long-term detrimental mental/emotional health of the physician and their future patients.

Specifically, in one study, 80.8% of physicians who had a closed malpractice claim reported significant emotional distress (regardless of the legal outcome), with frequent reports of mood symptoms that affected professional conduct.15 Recognizing these effects and implementing peer counseling and institutional support may help to expedite recovery and mitigate future adverse career outcomes.14

Anatomy/Timeline of a Liability Lawsuit

Medical malpractice cases are heard in state courts, in the jurisdictions where the care was provided. From the time an event occurs to when a jury verdict may be rendered may take 4-5 years or more depending on the local statute of limitations, discovery process, backlog of the local case docket, and specific circumstances of the case. The length of time is important to consider given the likelihood that a physician may advance in training or move practice locations during the course of litigation. Several common myths surrounding this process are summarized in the accompanying box, titled “Myths Surrounding Medical Liability Litigation.”

The plaintiff faces a statute of limitations to file a lawsuit that may range from 1-6 years depending on the state. The first indication that legal action may be pending will generally be a plaintiff’s formal request for medical records. After these records are reviewed, the plaintiff’s attorney will consult one or more experts (often credentialed in the same specialty) to assess if the case is viable and to ultimately form the basis of an affidavit of merit from a plaintiff expert.

Once the lawsuit is filed, the physician(s) named will be assigned an attorney by their employer/insurance company. A state medical board malpractice questionnaire will generally follow that will seek to independently evaluate the alleged malpractice with interrogatives to determine if censure is warranted. There is a formal response to the plaintiff’s petition by the defense and then the discovery phase begins where both sides depose the defendants/plaintiffs and retain medical experts that are favorable to their arguments.

In choosing potential “experts,” physicians must ensure that they are willing/able to be present for a potential trial, do not have any personal/professional/academic conflicts with the defendants, and are willing to provide compelling testimony to a jury. A pre-trial conference and trial date is set which may be >12 months away depending on the local docket. While the amount of time a trial may take is variable, it may be up to 5-7 days that the defendants are expected to be in court in addition to days where depositions are being taken.

During the discovery process, dismissal of the physician from the lawsuit is pursued. In addition, settlement negotiations generally proceed in parallel with discovery process and may result in a pre-trial/pre-verdict settlement. Once a verdict is reached, whether for the plaintiff or the defendant, the case may be appealed, and the trial preparation process may be repeated.

Conclusions

Awareness of the medical liability process is critical for trainees and attendings alike, given the high likelihood of litigation in a gastroenterologist’s career. Specific considerations like local tort law and malpractice coverage are important to be familiar. Ongoing health services research help to shape our understanding on the intended and unintended consequences of litigation on medicine, though detailed data on outcomes/settlements are limited by confidentiality agreements, which may hamper efforts to improve patient safety.

Dr. Das is associate professor of medicine in the Division of Gastroenterology at Washington University School of Medicine, St. Louis, Missouri. He has served as a consultant for Olympus, but has no other relevant conflicts.

References

1. Jena AB, et al. Malpractice Risk According to Physician Specialty. N Engl J Med. 2011 Aug. doi: 10.1056/NEJMsa1012370.

2. Chong RIH, et al. Scoping review of the second victim syndrome among surgeons: Understanding the impact, responses, and support systems. Am J Surg 2024 Mar. doi: 10.1016/j.amjsurg.2023.09.045.

3. Seabury S, et al. On Average, Physicians Spend Nearly 11 Percent Of Their 40-Year Careers With An Open, Unresolved Malpractice Claim. Health Aff Proj Hope. 2013 Jan. doi: 10.1377/hlthaff.2012.0967.

4. CRICO Strategies. Medical Malpractice in America: A 10-Year Asessment with Insights. 2018. Accessed Apr 28, 2025.

5. Studdert DM, Hall MA. Medical Malpractice Law — Doctrine and Dynamics. N Engl J Med 2022 Oct. doi: 10.1056/NEJMp2201675.

6. Schaffer AC, et al. Rates and Characteristics of Paid Malpractice Claims Among US Physicians by Specialty, 1992-2014. JAMA Intern Med. 2017 May. doi: 10.1001/jamainternmed.2017.0311.

7. Gandhi TK, et al. Missed and Delayed Diagnoses in the Ambulatory Setting: A Study of Closed Malpractice Claims. Ann Intern Med. 2006 Oct. doi: 10.7326/0003-4819-145-7-200610030-00006.

8. Studdert DM, et al. Prevalence and Characteristics of Physicians Prone to Malpractice Claims. N Engl J Med. 2016 Jan. doi: 10.1056/NEJMsa1506137.

9. Studdert DM, et al. Changes in Practice among Physicians with Malpractice Claims. N Engl J Med. 2019 Mar. doi: 10.1056/NEJMsa1809981.

10. Ries NM, Jansen J. Physicians’ views and experiences of defensive medicine: An international review of empirical research. Health Policy. 2021 May. doi: 10.1016/j.healthpol.2021.02.005.

11. Hiyama T, et al. Defensive medicine practices among gastroenterologists in Japan. World J Gastroenterol. 2006 Dec. doi: 10.3748/wjg.v12.i47.7671.

12. Elli L, et al. Defensive medicine practices among gastroenterologists in Lombardy: Between lawsuits and the economic crisis. Dig Liver Dis. 2013 Jun. doi: 10.1016/j.dld.2013.01.004.

13. Jena AB, et al. Physician spending and subsequent risk of malpractice claims: observational study. BMJ. 2015 Nov. doi: 10.1136/bmj.h5516.

14. Scott SD, et al. The natural history of recovery for the healthcare provider “second victim” after adverse patient events. BMJ Qual Saf. 2009 Oct. doi: 10.1136/qshc.2009.032870.

15. Gómez-Durán EL, et al. Physicians as second victims after a malpractice claim: An important issue in need of attention. J Healthc Qual Res. 2018 Oct. doi: 10.1016/j.jhqr.2018.06.002.

While nearly 75% of physicians in low-risk specialties and 99% of physicians in high-risk specialties may face a malpractice claim in their careers,1 malpractice is rarely discussed openly in medical school, residency, fellowship, or even amongst colleagues. Indeed, one study suggested that more than 10% of practicing gastroenterologists may face a malpractice claim,2 with gastroenterologists expected to spend 10-15% of their careers with an outstanding malpractice claim3 as cases may take 27-29 months to resolve on average.4

Believing that if a physician is sued, one must have done something “wrong” or that speaking about one’s experience may implicate a colleague, creates an intense stigma and isolation that only serves to aggravate the “second victim syndrome” (SVS) that is well documented in the surgical literature.2 Herein,

What is Malpractice? Why Do Physicians Get Sued?

Malpractice is defined as negligence on the part of a physician which causes physical or emotional damage to the patient. This requires a variety of legal issues to be evaluated (e.g. breach of duty between the physicians and patient, breach of standard of care), that often center around the question: would a “reasonable, careful, and prudent” doctor behave in the same manner in the same circumstance?

While some fields of medicine lend themselves better to algorithmic applications of highly evidence-based guidelines, many aspects of GI care and endoscopic practice are highly physician/patient-specific, dependent on local expertise, and based on low-quality evidence. As a result, an assessment of negligence may be quite subjective, depending on the expert retained by a plaintiff. Conflicting expert testimony on what professional custom is and whether practice deviates may hinge on technical details that may or may not be appreciated by a lay jury.

Plaintiffs must prove both that they have sustained an injury and that the injury (emotional or physical) was due to the physician’s negligence. While this may be straightforward in a “slip-and-fall” tort claim, medical malpractice claims usually involve sick patients with multiple comorbidities, where assigning causality to a single intervention/misinterpretation/missed opportunity is difficult to weigh against competing causes of adverse outcomes. Assessing a specific liability requires that the plaintiff prove this to a “more likely than not” standard which may be part of the reason why only 30% of cases are closed with indemnity payments, a figure that has not changed significantly in the past decade.4

While the perception amongst physicians is that tort legislation is ever increasing, data from the National Practitioner Data Bank (NPDB) demonstrates that the number of paid claims against physicians has decreased by 75% in the last 20 years.5 This may reflect a progressive improvement in the quality of care delivered or success of “tort reform” on the state level to limit damages and “nuisance” lawsuits. However, another more problematic possibility is that with the corporatization of medicine, an untold number of physicians may be removed from litigation as a named party, with their institution shielding them from reporting. While the number of cases may or may not be declining, the average indemnity payment appears to be rising to $330,000 on average,4 with one study suggesting a significant growth in paid claims in gastroenterology.6

Historically, studies of closed malpractice claims have demonstrated that 59% involved diagnostic errors involving a cancer diagnosis,7 though why this actually happens may be for a wide variety of reasons including errors in the development of a differential diagnosis, ordering of an appropriate diagnostic test, interpretation of the diagnostic test, or follow-up of an abnormality identified.

What are the Intended/Unintended Consequences of Litigation?

The objective of our tort system is to compensate patients for economic damages (medical costs and lost wages) and non-economic damages (pain and suffering), and to ideally deter negligent behavior of providers. Interestingly, data from the NPDB have suggested that approximately 1% of all physicians account for 32% of all paid claims, with the same study showing that among physicians with paid claims, 4% had at least 3.8

While certain fields are obviously more prone to litigation, the risk of additional claims on a physician with 3 prior claims was more than 3 times that of physicians with 1 lifetime claim. One would assume that the system was built to drive out a small proportion of “bad actors.” Indeed, similar data from the NPDB has demonstrated that the number of claims against physicians was associated both with their leaving the practice of medicine and relocating to smaller practice settings.9